Everyone should have the opportunity, access, and ability to reach their long-term financial goals to live the life they truly envision.

To maximize performance returns and reduce visible and invisible risks for real estate investors.

We manage conflict, compliance, and crazy while providing long-term investment strategies, proactive solutions, and performance results to meet your goals.

1836PM understands that there are many different types of investors. Our time-tested and proven processes are designed to work with all stages of investors.

Apprentice Investor

eager to learn

Dream Home Investor

willing to lease their dream home in order to move in later

Cash Flow Investor

building liquidity for more investments

Experienced Investor

knows the value and aligns with the program

Long-Term Planner

has the discipline to wait for the rewards

Personalities that are a bad fit for single-family home investing generally fall into these categories:

Apprehensive

fearful, timid, unable to make a decision

Cash-Strapped

not enough up-front capital to make an income-producing investment

Stubborn

knows more than the experts and doesn't align with the program

Bougie

prefers high-end upgrades and appearance over investment performance

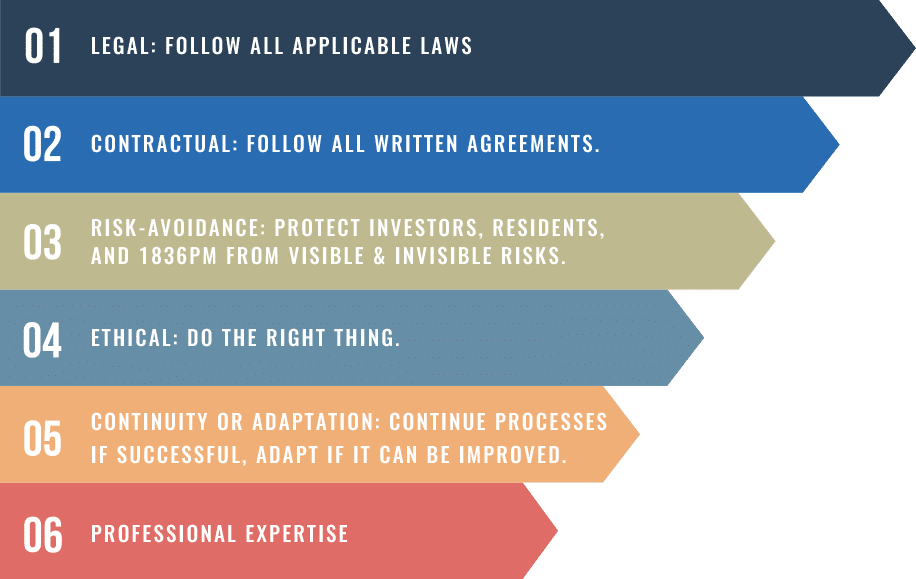

We call it the “1836PM Decision Making Hierarchy.” It’s based on a repeat or adapt perspective. Since day one, 1836PM has been implementing processes and procedures to ensure the success of our clients’ investments. Through the years we’ve either repeated certain processes if they’ve proved functional, or adapted if they did not. This is our Mode of Operation—an ongoing process as we strive to deliver the best possible investment management services to our clients, residents, and partners.

Our job is to work with you to achieve your investing goals while at the same time proactively managing and reducing risks — visible and invisible risks. We’ve been in the investment management business since 2007. Through years of refining our processes and procedures, we have learned precisely what it takes to maximize your return while significantly reducing lawsuits, fines, and the courtroom. To win as a team, we must agree on a game plan and remain diligent in executing it.

Take a deep dive into our specific services and pricing.

Group A:

Group B:

Group A:

Group B: